Jack Covert Selects - Wait

June 14, 2012

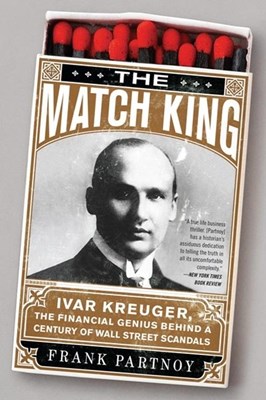

Wait: The Art and Science of Delay by Frank Partnoy, PublicAffairs, 304 pages, $26. 99, Hardcover, June 2012, ISBN 9781610390040 Frank Partnoy won the Biographies & Narratives section of our 2009 800-CEO-READ Business Book Awards for his outstanding history of Ivar Krueger in The Match King. I am a big fan of Biographies, so I was partial to it, but his was one of the best I’ve read in recent years.

Frank Partnoy won the Biographies & Narratives section of our 2009 800-CEO-READ Business Book Awards for his outstanding history of Ivar Krueger in The Match King. I am a big fan of Biographies, so I was partial to it, but his was one of the best I've read in recent years. Partnoy's new book, Wait, though not a biography, is just as well written.

It could be read as a narrative of latency, of how our brains have evolved and what it means for us in our present moment, and explains the powerful force of delay on our decision-making.

Professional tennis and baseball players follow the same two-step approach to good decision-making that we should follow in our longer-term personal and business decisions. First, they figure out roughly how much time they will have available to respond. Second, they delay their response as long as they possibly can within that time period. If you watch Albert Pujols hit a baseball in really slow motion, he looks just like Warren Buffett buying a stock: study the pitcher, watch the ball carefully, and don't respond to any opportunity until you have taken the time to decide if it is a good one. Wait as long as you can so you'll have a better chance of swinging only at fat pitches.Chapter Three, "High-Frequency Trading, Fast and Slow," is particularly fascinating in its implications for how we make decisions and manage the world. He begins the chapter by telling the story of UNX, a high-frequency trade firm that had become a leader in the market. It moved it's black box computers from the West Coast to NYC to speed up their transaction time by milliseconds, believing it would increase their yield, only to learn that the trades were actually getting worse. After manually delaying the transactions back to the speed it had taken to travel the continent—mere milliseconds—they returned to their former profitability.

Some continue to argue that high-frequency trading is inherently risky, "that increasing the speed of trading is not only socially wasteful but dangerous." But others view it as essential for increasing trade efficiency, and are simply building latency into their systems and putting pauses in their algorithms:

[O]ptimizing delay—buying and selling only a few shares during the first few milliseconds, like the initial feint of a fencing duel, to test how other traders respond.But regardless of whether we're talking about markets, sports, or warfare, the optimal instruction, according to Partnoy, is Wait—not to delay action, but the decision to act. If you are quick enough in your execution, if only by milliseconds, you can give yourself more time to make the all-important decision to act, and that can make all the difference.